Energy-efficiency unlocks growth opportunities for pump market

As growth within the global pumps market continues to pick up pace, it is driven by rapid development in the water, wastewater and sanitation, and chemical industries. Government stimulus programmes, which are encouraging manufacturing plants and industries to invest more in energy-efficient upgrades, will also boost innovation and technology development in pumps.

In the power sector investments alone are expected to touch $126.9bn in pumps in 2017. However, opportunities will vary across geographic regions and pump types. For instance, stiff competition from European and Asian manufacturers is likely to affect North American pumps sales, as improved quality and competitive pricing make these imports viable alternatives to American pumps.

Frost & Sullivan Industrial Automation and Process Control Research Analyst Shilpa Mathur Ramachandran, commented: “For the global pumps industry as a whole, long-term growth will be determined by manufacturers’ and suppliers’ competitive pricing strategies and their preparedness for disruptive shocks from other countries.”

She added:“Compelling, fresh, and strategic perspectives on collaboration and consolidation will be necessary to drive long-term growth of larger market players in the high-growth markets.”

Strategic Outlook of Global Pumps Market, 2017 is part of Frost & Sullivan’s Industrial Automation & Process ControlGrowth Partnership Service programme. The study covers the global opportunities for pumps companies in end-user industries, including oil and gas, wastewater, chemicals, food and beverages, plus the power sector and aftermarket services. It also offers a regional analysis of how economic factors affect the market. Major players in the market include Flowserve, Sulzer, Xylem, KSB, ITT, Ebara, SPX FLOW, Pentair, and Roper.

Some expected market developments for 2017 include:

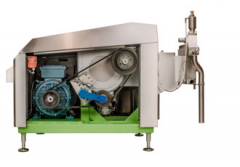

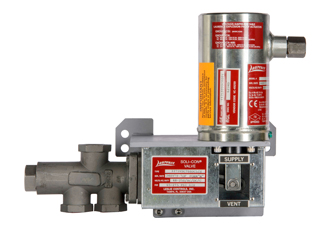

- Advanced design pumps with more electronic features that enable better system integration and system efficiency;

- Growth spurt in North America due to stabilising oil prices that will bolster the pumps market;

- Sustained growth expectations from China to boost Asia-Pacific pumps revenues;

- Growing innovations in robotics for upstream processing applications and primary packaging that will bring new opportunities for pumps;

- Slightly faster growth for Positive Displacement (PD) revenues than centrifugal pumps; rising investments in biotechnology for wastewater treatment and booming fracking activities in the United States will push demand for PD pumps, especially peristaltic and progressive cavity types

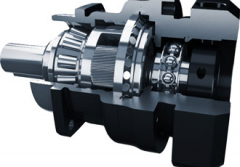

- Potential for high-pressure and high-flow centrifugal pumps in industrial applications; single- and multi-stage radial-flow pumps will be used extensively;

- Massive capital expenditure investments in specialty chemicals, will give competitive advantage to manufacturers offering a comprehensive package constituting flow control solution and automation technologies, along with diagnostic capabilities.

“Companies should focus on becoming solution providers rather than stand-alone equipment providers,” added Ramachandran. “Offering a full end-to-end solution is an important competitive factor in the mass commercial pumps market. Suppliers need to work with their clients to understand problems and then provide customised solutions.”

Similar articles

More from Frost & Sullivan

- The future of automotive body-in-white inspection 29th May 2019

- Integration IIoT capabilities to unlock new revenue streams 27th February 2019

- Digital industries and new growth opportunities 17th January 2019

- Innovating to harness growth generated by Manufacturing 4.0 15th January 2019

Write a comment

No comments